What is start-up deduction?

The starter's deduction is an additional deduction for entrepreneurs who have not been self-employed for long. Those who meet the conditions may deduct the amount of the starter's deduction from their profits on top of the self-employed deduction. The scheme is designed to give starting entrepreneurs extra financial leeway in the build-up phase of their business. The starter's deduction can only be applied if there is an entitlement to the self-employed deduction.

Terms

Three main conditions apply to qualify for the start-up deduction:

- Right to self-employment deduction

The start-up deduction can only be applied if you are also entitled to the self-employed deduction, a scheme that allows entrepreneurs to deduct a fixed amount from their profits. This means a person must be an entrepreneur for income tax purposes and meet the hour criterion of at least 1,225 hours per year. - Entrepreneur for less than five years

The scheme is designed for entrepreneurs who have been self-employed for up to five years. Those who have been in business for more than five years are no longer eligible for the start-up deduction. - Applied no more than twice before

In the past five years, the start-up deduction may have been used a maximum of twice before. As a result, the deduction can be applied a total of three times within the first five years of entrepreneurship

Hours criterion

To qualify for certain deductions, you must meet the Inland Revenue's hours criterion, which requires you to spend at least 1,225 hours a year on your business. This includes all work directly or indirectly related to the business, such as assignments, administration, acquisition and training. Only when this criterion is met are you entitled to the self-employed deduction and start-up deduction. Accurate time recording remains essential as proof in case of audit.

State pension age

When the state pension age is reached in the calendar year, a modified scheme applies. Both the self-employed deduction and the start-up deduction are halved in that year. The deductions are thus aligned with the fact that the entrepreneur is only liable to tax at the regular rate for part of the year.

Find out more at the Inland Revenue's official page on the start-up deduction at state pension age.

How high is the start-up deduction in 2025?

The amount of the start-up deduction is set each year by the Tax Administration. In 2025, the amount remains the same as in previous years. The following table summarises the amounts:

Year | Amount start-up deduction |

2023 | € 2.123 |

2024 | € 2.123 |

2025 | € 2.123 |

The start-up deduction comes on top of the self-employed deduction, which amounts to €2,470 in 2025. Together, these deductions can add up to €4,593 provided all conditions are met.

Start-up deduction for incapacity to work

Entrepreneurs who are partially or fully disabled can also benefit from a modified start-up deduction. The conditions are largely the same, but the Tax Administration applies a reduced hour criterion of 800 hours and a separate, generally lower, deduction amount. The scheme is designed to encourage entrepreneurs with a labour disability to start or continue their own business.

How many years cann you apply the start-up deduction?

The start-up deduction can be applied a maximum of three times within the first five years after a person becomes an entrepreneur for income tax purposes. The scheme is therefore not available every year, but only in the years in which all conditions are met. In the tax return, the entrepreneur himself indicates when the deduction is applied; the Tax Administration checks this afterwards.

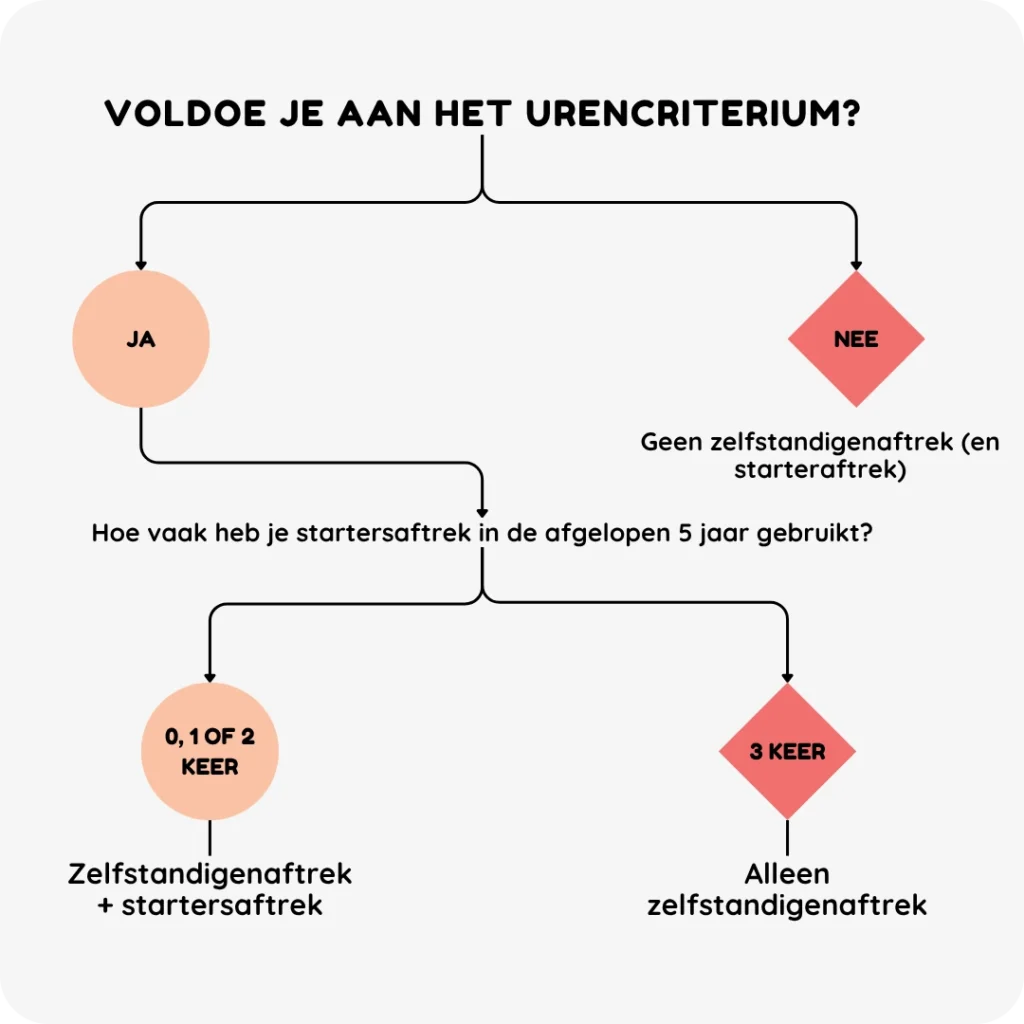

Overview: self-employment deduction & start-up deduction

The following figure shows at a glance when you are entitled to the self-employed deduction and the start-up deduction. The overview starts at the hour criterion and makes it clear which deductions apply to starters and which only to entrepreneurs who have been in business for some time.

Example application

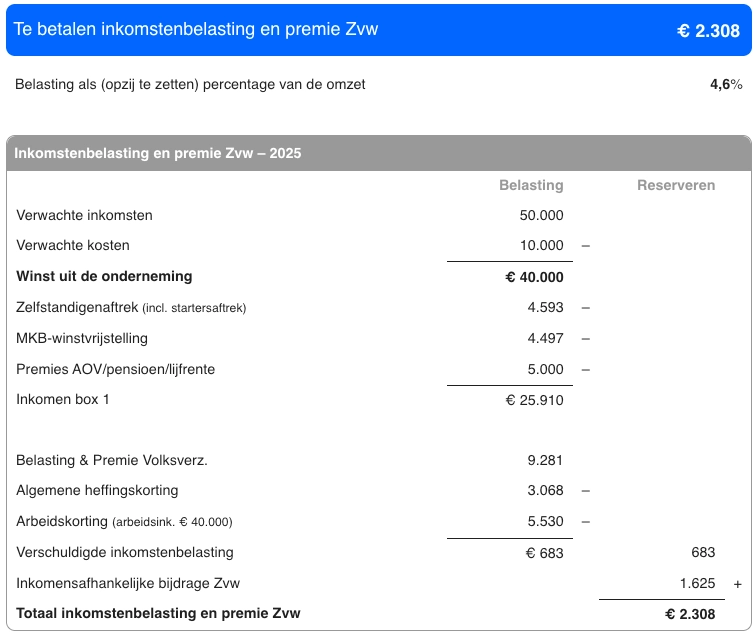

Suppose you are a self-employed person with €50,000 turnover and €10,000 expenses in 2025. You meet the hour criterion and are entitled to the self-employed deduction. Because you are a starter, you may also apply the starter's deduction in addition. Together, these deductions provide an additional tax benefit of €4,593.

After applying the self-employed deduction, the SME profit exemption and deducting AOV/pension contributions, your taxable income drops from €40,000 profit to €25,910. As a result, you end up paying only €2,308 in income tax and Zvw, or 4.6% of your turnover.

This example shows well that the self-employment deduction, especially when combined with the start-up deduction, makes a significant difference in how much tax you actually pay.

Are you self-employed and also have income from employment? Then the calculation works slightly differently. In that case, use our calculation tool for self-employed and salaried workers To make a correct calculation.

Applying for start-up deduction in the tax return

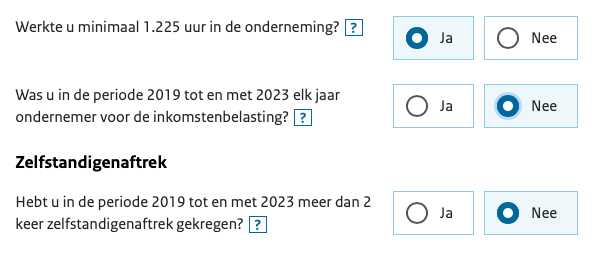

If you indicate in your tax return that you meet the hours criterion, you can turn on the self-employed deduction. This is automatically followed by a question about previous years: whether you have used the self-employed deduction before. If in the past 5 years you have had the self-employed deduction at most twice and you were not an entrepreneur all those years, you can also turn on the start-up deduction. Both schemes will then be processed directly in your tax return.

Example from income tax return

Lower profit than deductions

If the profit is lower than the total of the self-employed deduction and start-up deduction, the unused portion is automatically carried forward to a subsequent year. This is called the unrealised self-employed deduction. In later years, this amount can still be set off as soon as the profit is high enough. The Inland Revenue automatically processes this in the tax return.

Frequently Asked Questions

How long does the start-up deduction apply?

The start-up deduction applies for up to three years within the first five years of entrepreneurship.

When do you apply the start-up deduction?

The deduction is applied in the years when all conditions are met and there is a right to self-employment deduction

What is the difference between self-employment deduction and start-up deduction?

The self-employed deduction is a general scheme for all entrepreneurs who meet the hour criterion. The start-up deduction is a temporary increase of it, specifically for nascent entrepreneurs.

What if the 1,225 hours is not met?

If the hour criterion is not met, both the self-employed deduction and the starter's deduction are forfeited. No use can then be made of these tax benefits.

How much discount does a starter get in the first three years?

The combination of self-employment deduction and start-up deduction provides a tax advantage of several thousand euros per year in the first years, depending on profits and other deductions.