What is the hours criterion?

The hour criterion means that, as an entrepreneur, you must spend at least 1,225 hours per calendar year on your business. This is a condition for qualifying for important deductions within income tax, such as the self-employed deduction and the start-up deduction. It is about 24 hours per week on average, spread throughout the year. The criterion is designed to reserve tax benefits for entrepreneurs who run their business seriously and structurally. In this way, the Inland Revenue distinguishes between hobby income and genuine entrepreneurship.

Self-employment deduction

If you meet the hours criterion, you can deduct €1,200 from your profits in 2026 via the self-employed deduction. You deduct this amount before paying tax, which can significantly reduce your overall tax burden. The benefit applies to all entrepreneurs who meet the conditions, even if you have been an entrepreneur for several years.

Start-up deduction

Have you just started doing business? Then, if you are also entitled to the self-employed deduction, you may use the start-up deduction. This is an additional tax benefit of €2,123 in 2026, especially for new entrepreneurs. You can apply this deduction up to three times in the first five years of your business, as long as you continue to meet the hour criterion.

Conditions of the hours criterion

To meet the requirements, you must work at least 1,225 hours on your business. If you start later in the year, you still need to meet this number. Also, in many cases, you must spend more time on your business than on other work, such as salaried employment.

Which hours count?

Not only the hours you work directly for clients, but also all the time you put into your business counts. Think of administration, travel time to assignments, marketing, training or maintaining your website. Even the preparation hours you make before registering with the Chamber of Commerce can be counted. So everything that demonstrably contributes to your business helps you reach the 1,225-hour limit.

What doesn't count?

You may not count hours when you are only available without working, holidays or sick hours. Even work in an unusual partnership with your partner may not count in full.

Registering hours

A reliable record of hours is crucial to substantiate the hours criterion. You can easily keep track of this in an Excel sheet, an accounting program or a dedicated hour registration app. It is important that you always note date, activity and number of hours. Supporting evidence, such as diaries, invoices, quotations or e-mails, strengthens your records. This way, when audited, you can convincingly demonstrate how much time you actually put into your business.

Inland Revenue audit

The Inland Revenue relies primarily on your own declaration. Nevertheless, there may be an audit. Then you must be able to prove that your hours are realistic given your turnover and activities. Good administration is indispensable for this.

Penalty hours criterion

If you do not meet the hour criterion or cannot prove this in an audit, you will lose the right to the self-employed deduction (and possibly also the start-up deduction). This means that you have to pay more income tax, as your tax benefit is lost.

There is usually no separate fine, but the Inland Revenue can correct your assessment retrospectively. This often leads to a retrospective tax assessment, plus possibly interest or a penalty for non-compliance if it turns out that you deliberately provided incorrect data.

Hours criterion in case of incapacity for work

If you are unfit for work, a reduced criterion of 800 hours per calendar year applies. This allows you to still make use of entrepreneurial deductions, such as the self-employed deduction or the start-up deduction in case of occupational disability. To do so, you must be able to prove that your health enables you to work fewer hours.

Maternity leave

With maternity leave, you don't have to worry about missing out on hours. You may count the period of up to 16 weeks' leave as if you had worked as normal during those weeks. This is based on your average number of working hours per week.

Hours criterion not met?

If you do not reach the 1,225 hours, your right to the self-employed deduction and start-up deduction will be lost. However, you will always be entitled to the SME profit exemption of 12.7% of your profit.

Started as self-employed later in the year?

Even then, the full 1,225 hours will apply. If you start in July, you will have to make more than 47 hours a week in six months to meet the criterion. In that case, it is often smarter to move your start to January.

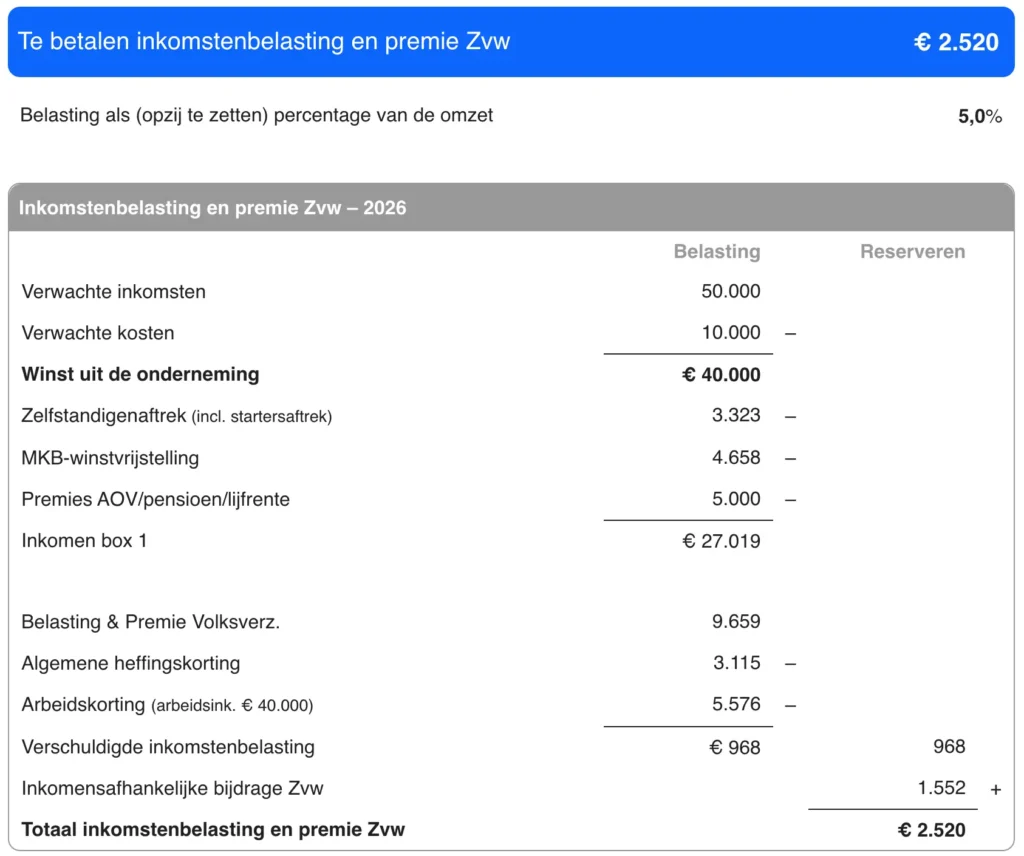

Hours criterion met? Example application

Suppose you are a self-employed person with €50,000 turnover and €10,000 expenses in 2026. Because you meet the hour criterion, you are entitled to the self-employed deduction. If you are also a starter, you may also apply the starter's deduction. Together, these deductions yield a tax benefit of €3,323.

After applying the self-employed deduction, the SME profit exemption and deducting AOV/pension contributions, your taxable income drops from €40,000 profit to €27,019. As a result, you end up paying only €2,520 in income tax and Zvw, or 5% of your turnover.

The following example clearly shows that the hour criterion is the key to making use of the self-employed deduction (and start-up deduction). If you do not meet this, this tax benefit is immediately forfeited.

Are you self-employed and also have income from employment? Then the calculation works slightly differently. In that case, use our calculation tool for self-employed and salaried workers To make a correct calculation.

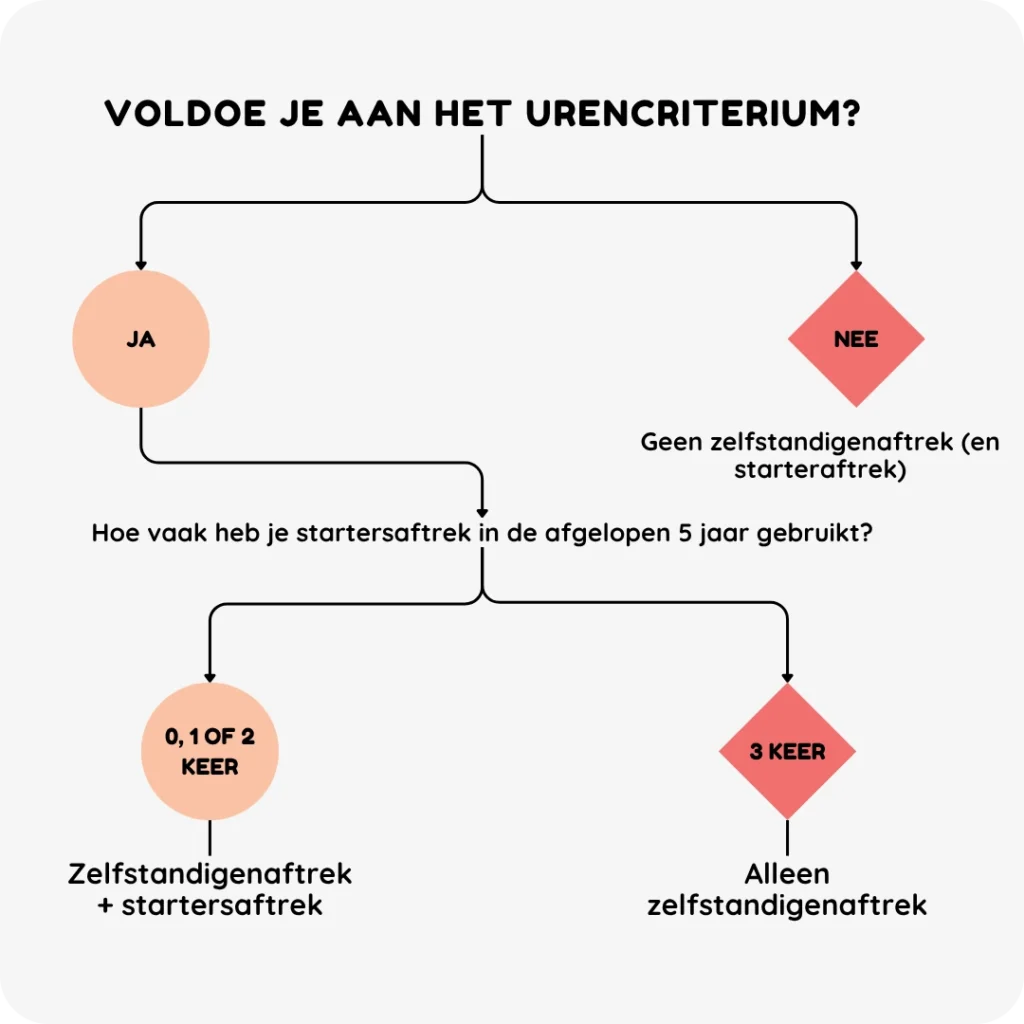

Overview: hours criterion, self-employment deduction & start-up deduction

The following chart shows at a glance how the hour criterion is related to the self-employed deduction and the start-up deduction. If you meet the 1,225 hours, you are entitled to these tax benefits. Moreover, if you are a starter, you will get additional deductions. If you do not meet the hour criterion, the benefits will immediately lapse.

Hours criterion: self-employed alongside salaried employment

If you combine entrepreneurship with a salaried job, it becomes more difficult to meet the hour criterion. Even if you are self-employed in addition to your job, you must put at least 1,225 hours into your business. For starters, there is no additional requirement: it is purely about the number of hours. If you are active for longer, you also have to devote more time to your business than to your salaried job. In practice, this means that the criterion is usually only achievable with a part-time job or if your salaried work is limited to a few days a week.

Frequently Asked Questions

How is the hours criterion monitored?

The Inland Revenue randomly checks whether your hours are plausible. You must substantiate this with time records and supporting documents.

What if you don't reach the 1,225 hours?

Then self-employed deduction and start-up deduction expire. You will only benefit from the SME profit exemption.

What does it mean for the hours criterion if I am also in the KOR?

Nothing. The KOR (VAT exemption on turnover below €20,000) is separate from the hours criterion.

How strict is the hours criterion?

The limit is hard: 1,225 hours or more. When audited, you must be able to prove this plausibly. Without proof, you lose your deductions and the Inland Revenue can impose corrections