What is the self-employment deduction?

The self-employed deduction is a tax scheme specifically designed for entrepreneurs. If you meet the conditions, you can annually deduct a fixed amount from your profit before paying tax. As a result, your taxable income will be lower, meaning you will ultimately pay less income tax. The idea behind the scheme is that entrepreneurs run more risk than employees: you have no sick pay, no pension scheme and less security. The self-employed deduction partly compensates for this and can give you hundreds to thousands of euros of benefit every year.

How high is the self-employment deduction?

In 2026, the self-employed deduction is €1,200. If you meet the hour criterion and the other conditions, you may deduct this amount from your profit before paying tax. This reduces your taxable income, which means you pay less tax at the end of the day. Exactly how big the benefit is depends on your profit and the tax bracket you fall into, but it can amount to hundreds of euros per year.

Phasing out: will the self-employed deduction disappear?

The self-employed deduction will be phased out over the next few years. In 2024, the deduction was still €3,750, while in 2026 it was already reduced to €1,200. According to the Tax Plan, the amount decreases further to eventually €900 in 2027. The aim of this is to narrow the tax gap between employees and the self-employed. For you as an entrepreneur, this means that the it will be less and less beneficial and that it will become important to make the most of other deductions.

Year | Self-employment deduction |

2022 | € 6.310 |

2023 | € 5.030 |

2024 | € 3.750 |

2025 | € 2.470 |

2026 | € 1.200 |

2027 | € 900 |

Unrealised self-employed deduction

It may happen that your profits in a year are too low to use the full self-employed deduction. In that case, you do not lose the benefit: you can carry the remaining part forward to a subsequent year. This is called the unrealised self-employed deduction. As soon as your profit is high enough, you can still set off this amount and still benefit from the tax advantage.

Terms

You are not automatically entitled to the self-employed deduction. The tax authorities look at several conditions, including:

- You must be an entrepreneur for income tax purposes. The Inland Revenue assesses this based on, among other things:

- How many clients you have,

- Whether you are at entrepreneurial risk,

- And whether you work independently.

- You must meet the hours criterion: Spending a minimum of 1,225 hours per calendar year on your business.

- You must not have reached the state pension age yet: Are you eligible for AOW in a year? Then you will still get only half of the self-employed deduction.

These rules ensure that the deduction only applies to entrepreneurs who run their businesses seriously and actively.

You can test this yourself with the entrepreneur check from the tax authorities.

How often can you use it?

You can apply the self-employed deduction every year as long as you meet the conditions. So there is no maximum number of times. However, the amount of the deduction will continue to decrease in the coming years, reducing the benefit.

Hours criterion self-employed deduction

The hours criterion is the key to becoming entitled to the self-employed deduction. You must have at least Devoting 1,225 hours per calendar year to your business. Not only paid hours count here, but also things like administration, travel time, marketing and training. If you cannot prove this, you are no longer entitled to the self-employed deduction. It is therefore important that you keep careful records of your hours that you can show when audited.

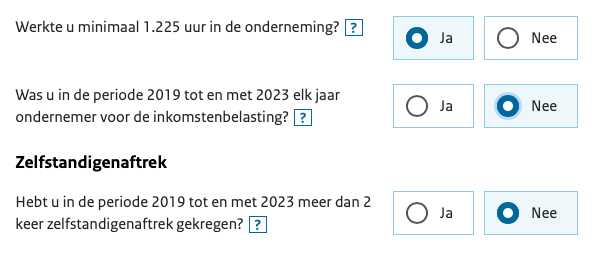

Applying self-employment deduction

You apply the self-employed deduction in your annual income tax return. You enter your turnover and costs there, after which the profit is automatically reduced by the self-employed deduction and any other deductions. The amount that then remains is your taxable income and you pay tax on it. So you see the advantage immediately: the more deductions you can use, the less tax you pay. It is wise to already take this into account during the year. That way, you will have a better idea of what you have to pay to the tax authorities and will not be faced with any nasty surprises when filing your tax return.

Example from income tax return

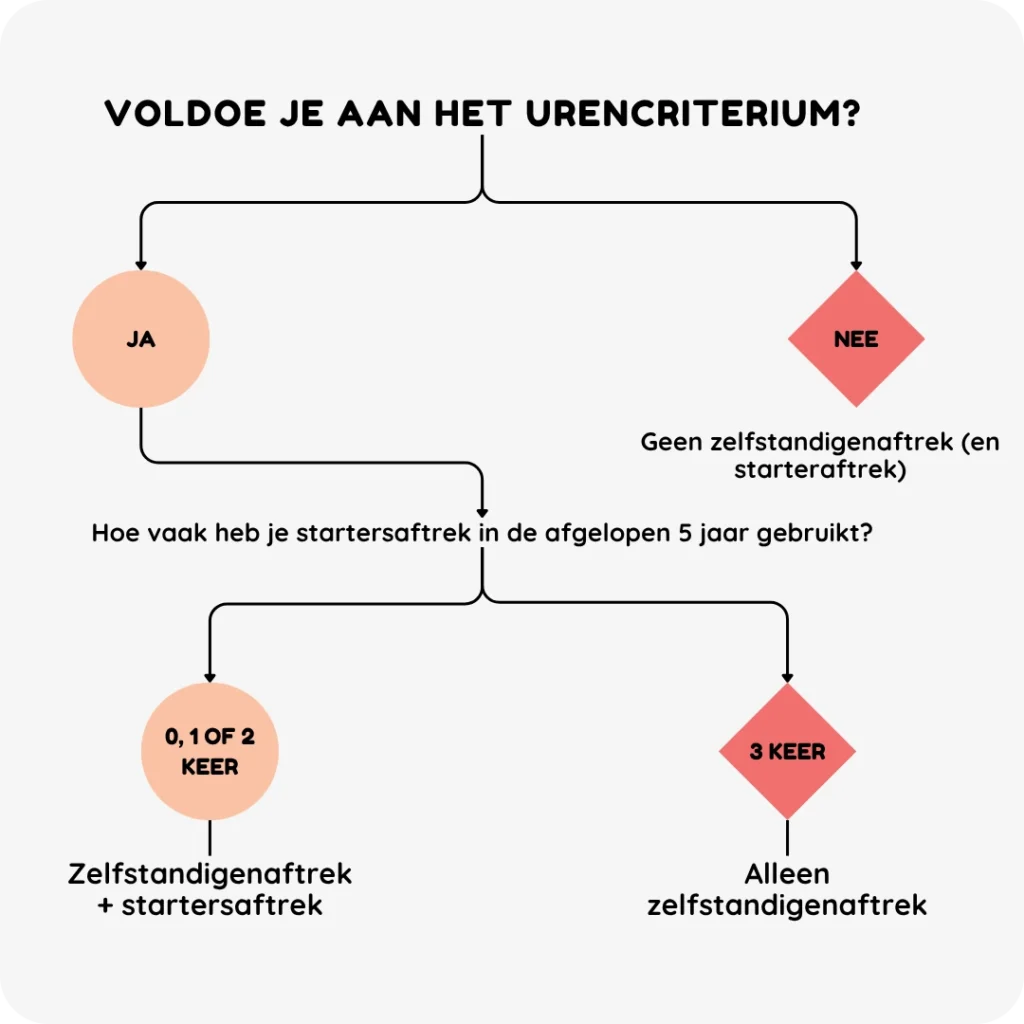

Overview of deductions: self-employment deduction & start-up deduction

The self-employed deduction and start-up deduction are closely linked. If you meet the hour criterion and are an entrepreneur for income tax purposes, you are entitled to the self-employed deduction. If you are additionally a starter, then the start-up deduction (additional benefit) on top of that.

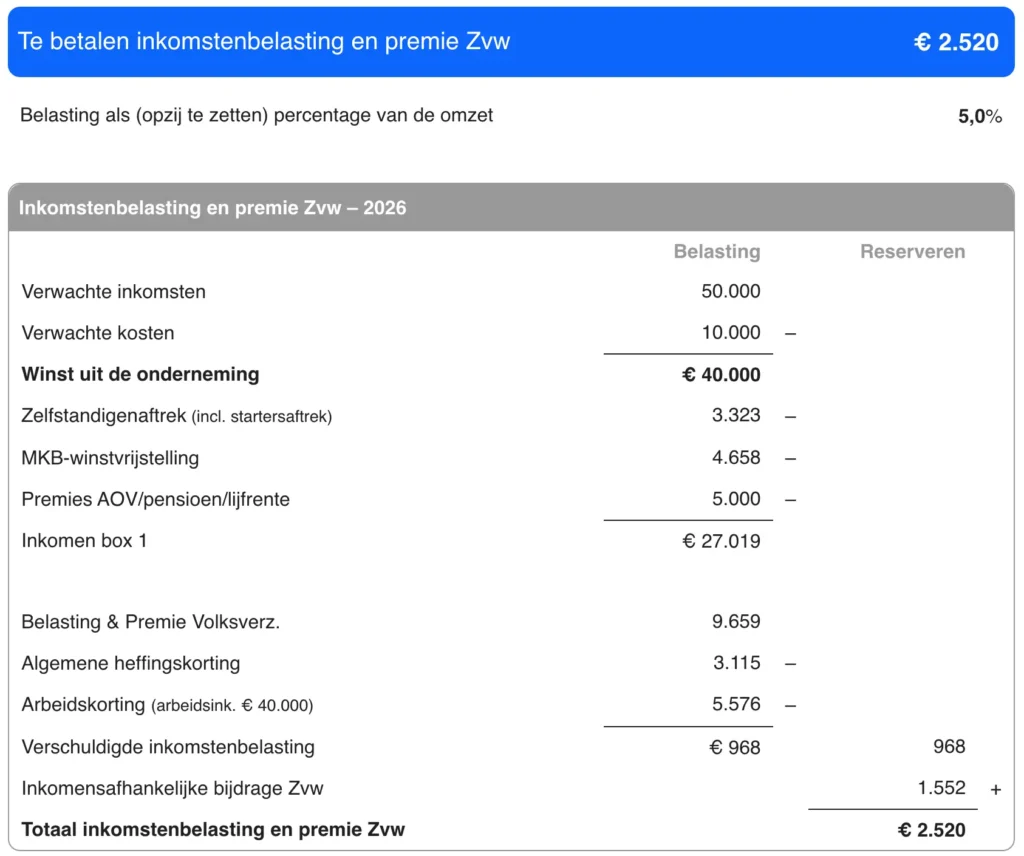

Sample calculation

The following example involves a self-employed person with €50,000 in turnover and €10,000 in expenses. This brings the profit from business to €40,000.

Since the hours criterion is met, the entrepreneur can apply the self-employed deduction. In 2026, together with the starter's deduction, this amounts to €3,323. This amount is directly deducted from the profit, reducing the taxable profit.

As a result of this deduction, you do not pay tax on €40,000, but on a considerably lower amount. The difference is tangible: thanks to the self-employed deduction and other schemes, the taxable income drops to €27,019 and ultimately only €2,520 in tax and Zvw remains.

Are you self-employed and also have income from employment? Then the calculation works slightly differently. In that case, use our calculation tool for self-employed and salaried workers To make a correct calculation.

Frequently Asked Questions

What does the self-employed deduction mean?

It is a fixed deduction that reduces your profits and makes you pay less tax.

How high is the self-employed deduction in 2026?

In 2026, the self-employed deduction is €1,200.

How high is the self-employment deduction in 2025?

In 2025, the self-employed deduction will be €2,470.

How do I prove I meet the hours criterion for the self-employed deduction?

You need to keep records of hours with, for example, diaries, invoices and work reports.

What if you don't reach the 1,225 hours?

Then your right to the self-employed deduction and possibly the start-up deduction will be lost.

Does the self-employed deduction disappear altogether?

Yes, the self-employed deduction will be phased out over the next few years until it disappears completely.